By Anna De Cheke Qualls

By Anna De Cheke Qualls

There is usually a great story behind a splendid wine. Take Ágoston Haraszthy, the flamboyant Hungarian entrepreneuer who came to the United States in 1840 to try his fortune. Besides founding a town, producing bricks, running a farm and steamboat, he planted grapes in Wisconsin, then established California’s Buena Vista winery. Haraszthy’s passion and focus were boundless, not unlike Napa winemaker Jim Kaplan (’70 PhD, Mathematics), whose career has spanned many lifetimes and adventures.

When he is not sitting in his Boston office, Kaplan splits his time between running his acclaimed Aftermath winery, his company Cubic Asset Management, serving as Chair of the Board at Newton-Wellesley Hospital, grandchildren, and travel. Those who know Kaplan wonder how he makes time for it all -– 20+ hours a week of service to the hospital, on top of juggling everything else. And yet, his trademarks to this day are adaptability, precision, humor, thoughtfulness, and passion.

This full and exuberant life is a long way from growing up in Brooklyn. Kaplan’s father, a sheet metal worker, was unemployed for several years during his childhood. His mother, who earned her doctorate in Law, pivoted her career to education once three children came along. Despite a modest upbringing, there was a strong focus on education. To no one’s suprise, in 1966 Kaplan completed his undergraduate degree in Mathematics at Brooklyn College. By this time the Vietnam War was well under way. “There was a draft, and I knew I was potentially in imminent danger. I wanted a field where I would be able to defer, and that meant focusing on the sciences and mathematics. I was typically good in math, liked it and decided to go in that direction,” recalls Kaplan.

And he was not alone. According to the U.S. Census Bureau’s ‘Educational Attainment in the United States’ reports for the Vietnam War Era years, undergraduate and graduate enrollment by young men noticeably increased. And like others, Kaplan went straight into a doctoral program at Maryland-–which, at the time, offered him both the best academic program and financial package. “For the campus, these were tumultuous times. I remember quite well a protest in the Spring of 1970 against the war. There were literally thousands of protesters, and the state police tear gassed the crowd. The suffocating feeling is still vivid,” remembers Kaplan.

The war and the murder of Dr. Martin Luther King, Jr. in 1968 was a tumultuous backdrop to Kaplan’s doctoral experience. Recently married, he and his wife lived in Greenbelt’s Springhill Lake Apartments while he completed his research. His dissertation focused on delay differential equations under the guidance of the brilliant, and singular Dr. James A. Yorke, originator of the term ‘chaos’ in mathematics. This unique friendship and academic partnership was to last beyond Kaplan’s four years at Maryland. When Kaplan landed a faculty position at Northwestern University, and later at Boston University, the team continued to publish, including a well-known paper in 1979 on the dimension calculations of a fractal through the Kaplan-Yorke conjecture.

Over his 15-year academic tenure, Kaplan authored or co-authored 35 peer-reviewed papers, taught a regular schedule of courses, and wrote a textbook. Still, he was “living on marginal income and was looking for a way to supplement his living,” recalls Kaplan. Following an earlier interest in the stock market, he read mathematician Edward Thorp’s classic Beat the Dealer about card counting. “I learned to be a card counter and would occasionally play in a casino. I didn’t bet a whole lot and I didn’t make a whole lot. I have a good memory and I could count quickly, and that’s what’s involved,” says Kaplan.

It didn’t end there. Kaplan then read Beat the Market, co-written by Thorpe and Sheen Kassouf. It was the late 1960s and stock options weren’t trading at the time. You could only trade warrants. Both confer the right to purchase some underlying security for a fixed time period for stocks at a set price. They are different in who/what issues them-–a person versus a company. Invariably, though, both have an element of risk-–if a warrant expires, it becomes worthless. On the other end, if you can compute the intrinsic value for a warrant, you might make some serious money. Up to this point, this was somewhat unchartered territory.

And in 1973, before personal computers, two events occurred. The Chicago Board Options Exchange was created, and Fisher Black and Myron Scholes published a formula for computing the theoretical value of an option. Anyone who could solve this formula had an edge. Kaplan was one of them. He was able to numerically solve the game-changing Black-Scholes equation with a hand calculator. After all, in his mind, money was a dynamic fluid, and its behavior could be predicted by differential equations. “Money will always flow to the highest return opportunity. The way it diffuses in the system is similar to the way heat diffuses in a table-- if you heat one end, the other end will get warm. So the movement of money and how it flows is, in fact, governed by differential equations,” explains Kaplan. “I had a young friend and I said to him ‘I think I can make us some money. I think I know when options are overpriced and when they’re underpriced.’ I combined this with the ideas that Thorpe and Kassoof had about warrants. I had $15,000. I asked him throw in the same, and I said I’d manage it all. My friend and later his wealthy father made a leap of faith, and that’s how my investment career launched. It’s a great bit of whimsy-–we are still friends after 40+ years. He was willing to back me and see me build a business on my own,” adds Kaplan.

The year was 1976. Kaplan was still a professor at the time, and managing investments in his spare time. “I figured having only one client was a bad business strategy so I started working with anyone who would basically give me a dollar. I started with colleagues and friends through very modest sums of money--from $25K - $40K. The business gradually started to grow until it reached a point in the early 1980’s where I thought I might be able to make a living doing this,” remembers Kaplan. And he did. By 1985, Kaplan was fully transitioned out of academe, and retired.

Just in time for the rise of personal computers, and the decline of his proprietary advantage over the average stock dabbler. After Kaplan read Warren Buffet’s annual reports, he morphed into a self-taught value investor. “I started marketing myself. Marketing sounds grandiose because it involves some cohesive strategy. I basically sold myself to anyone who would listen. I would go into the local Merrill Lynch office and I would buy all the brokers lunch to try to tell them my story, and usually only 2 out of 50 would come. But if one broker wanted to work with me he would refer 6-7 other clients. I gradually built up a business, and I hired a smart guy who worked with me for 22 years-–together we made a very good team,” recalls Kaplan.

But Kaplan was not one for stagnation. He had his eyes on the pension consulting business--the people who design, implement, and manage employer-sponsored retirement programs. Kaplan and his partner were new to the game, however. “As a response, we said we’d restrict ourselves to small company stocks rather than any company stocks, and it turned out we were really good at that. And we were able to build up a little business,” says Kaplan.

Then, by a stroke of luck, Kaplan was introduced to former New England Patriots left guard John Hannah. “He was a really smart guy, and he set up a little consulting company to compete with the big ones. His edge was that he was able to get in to talk to people who wanted to see him because he was a famous athlete. But he knew that if he brought the same money managers to people that the big companies did, he had no value added. He decided to look for undiscovered guys. And he found us,” recalls Kaplan. Hannah put Kaplan’s firm in a search for a city pension plan in Lowell, Massachusetts. They were selected, and Kaplan’s group put up very good numbers for several years. The results were distributed in various public databases. “All of a sudden we went on the radar screen of every big company that was looking for a small cap value manager. And from 1993-1998 Pension and Investment Magazine rated us the #1 small cap value manager in the U.S.,” adds Kaplan. J.L. Kaplan Associates landed the small cap value piece of Lockheed Martin’s pension plan, Astra Zeneca, Ryder Truck, Goodrich, 36 college endowments, including Maryland and Johns Hopkins. The tiny business became a $5 billion firm that sold in 2002 to Wachovia’s Evergreen Investments. “It was for more money than I ever fantasized about. And when my five years there was up, I started the company I now have, Cubic Asset Management,” recalls Kaplan.

And now that he had the means, Kaplan decided to do a little bit of philanthropy. He set up a fund in Maryland’s Mathematics Department for graduate students to travel to conferences. His largest philanthropic gift went to Newton-Wellesley Hospital’s joint replacement surgical center. “If you give enough money, you end up on the board, whether you know anything about healthcare or not,” remarks Kaplan. Since 2006, he has served on Newton-Wellesley’s board, and earlier this year was elected as chair. This position comes with a board seat at Partners Health Care, the parent company of Massachusetts General Hospital and Brigham & Women’s Hospital.

Kaplan was able to realize one other ambition-–a foray into the world of wine. From his early days as an investor, he developed a penchant for this ancient concoction. “In those days, I could only afford anything that came with a straw. If it was $3 a bottle, I could afford it. Otherwise, I couldn’t,” recalls Kaplan.

Kaplan first bought into some liquor stores, and a wine distributor. The move wasn’t about the money. It was about access-–trade-only conferences, wine at wholesale prices, and trips to places like Bordeaux, Burgundy, Italy, Croatia, and Hungary. It was when Kaplan visited Napa for the first time that he really fell down the rabbit hole. So a few years after the 2002 windfall sale of his firm, his wife agreed that he buy a vineyard.

In 2011, Kaplan bought a 15-acre property on the Silverado Trail and hired renowned wine maker Dave Phinney, viticuluralist Steve Matthiason, and vineyard manager John Truchard. The team, with a deep pedigree in the wine business, now produces about 500 cases a year of critically acclaimed wine. The Cabernet Sauvignon, in particular, is served at fine restaurants in Maryland, California, Texas, Florida, Massachusetts, New Mexico, and Grand Cayman.

“When it comes to wine or anything else, Jim is a perfectionist. He takes an academic approach to anything he engages in-–wine, healthcare, business. He takes the soup-to-nuts approach to all things. He is a farmer-–he understands the vineyard as much as the wine making, and the wine. In this same way, he has been able to grasp complex clinical topics in a way that is uncommon for non-medical people. He is one of the most engaged, interested students of life I have known. Even today, he takes nothing for granted and searches for what’s fresh and new,” observes colleague Dr. Les Selbovitz, former Chief Medical Officer at Newton-Wellesley Hospital, and current Chief Medical Officer at Milford Regional Medical Center and Clinical Professor of Medicine at Tufts University.

in-–wine, healthcare, business. He takes the soup-to-nuts approach to all things. He is a farmer-–he understands the vineyard as much as the wine making, and the wine. In this same way, he has been able to grasp complex clinical topics in a way that is uncommon for non-medical people. He is one of the most engaged, interested students of life I have known. Even today, he takes nothing for granted and searches for what’s fresh and new,” observes colleague Dr. Les Selbovitz, former Chief Medical Officer at Newton-Wellesley Hospital, and current Chief Medical Officer at Milford Regional Medical Center and Clinical Professor of Medicine at Tufts University.

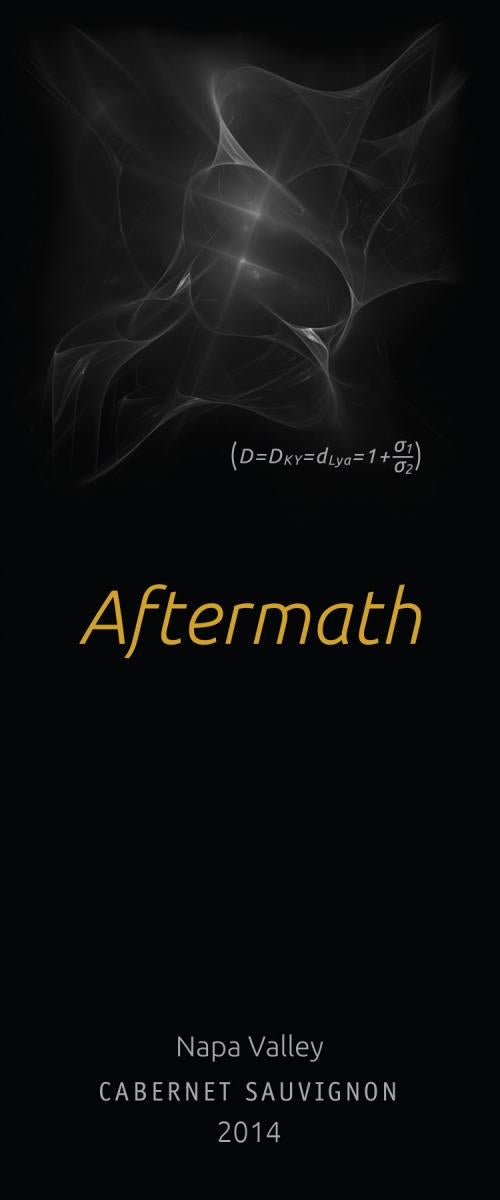

And in homage to his roots, Kaplan named his wine Aftermath. And remember the Kaplan-Yorke conjecture? Bottles are labeled with this formula and a fractal--a visual representation of ordered chaos, that’s everywhere around us, even as grapevines or Mangbetu sculptures. And, when any material is fractalized, it is broken down into smaller, self-similar parts.

The whole entity then becomes greater than the sum of its parts-–be it in mathematics, the stock market or wine. Kaplan has successfully navigated these and other arenas over his lengthy career precisely because he has this perspective. He concludes, “I think I have always been a good gestaltist. I am able to see relationships and similarities between disparate concepts, and form a cohesive worldview from them.”

(Photo Credits: Dr. James Kaplan)